Calculate percentage of tax from paycheck

In 2021 there are seven tax brackets with each one having a different tax rate ranging from 10 to 37. Also Giovanni deposits his paycheck deposits other loan proceeds and pays his bills during the same period.

Payroll Tax What It Is How To Calculate It Bench Accounting

To calculate Social Security withholding multiply your employees gross pay for the current pay period by the current Social Security tax rate 62.

. How to calculate FICA payroll tax Social Security withholding. Youll need the following. The calculator on this page uses the percentage method which calculates tax withholding based on the IRSs flat 22 tax rate on bonuses.

The percentage method and the aggregate method. Date put into service. We assume you will live to 95.

Most people watch chunks of each paycheck disappear toward their tax liability throughout the year with little understanding of. Accumulated depreciation up to this tax year. Giovanni deposits 1500 in an account on August 8 and on August 18 writes a check on the account for a passive activity expense.

How Income Taxes Are Calculated First we calculate your adjusted gross income AGI by taking your total household income and reducing it by certain items such as contributions to your 401k. The first is a sales tax of 205 for retail sales and 137 for sales made in restaurants and bars. There are two ways to calculate taxes on bonuses.

Estimate your self-employment tax and. A tax bracket is a range of taxable income that is subject to a specific tax percentage. Calculate your tax using the percentage method option 1.

That amount is then withheld from your bonus for federal taxes. To get a percentage. IRS Tax Withholding Assistant - The IRS has created a spreadsheet that can be used to calculate federal tax withholding.

Free calculators for your every need. IRS Publication 15-T Federal Income Tax Withholding. For 2022 the solar tax credit is worth 30 of the installation costs.

There are two taxes on spirits in Washington. The percentage of bonus depreciation phases down in. It aligns with changes made by the 2017 Tax Cuts and Jobs Act TCJA.

Also we separately calculate the federal income taxes you will owe in the 2020 - 2021 filing season based on the Trump Tax Plan. Washington State Spirits Tax. Paycheck to get a bigger refund Get started.

To calculate your tax based on your mill rate divide your assessed value by 1000 and multiply the result by your mill rate. Once you have the adjusted annual wages you can use the tax table found on page 6 of IRS Pub 15-T and calculate the annual federal income tax amount. To calculate how much house you can afford use the 25 rulenever spend more than 25 of your monthly take-home pay after tax on monthly mortgage payments.

We automatically distribute your savings optimally among different retirement accounts. Wage bracket method and percentage method. Occupation code Occupation title click on the occupation title to view its profile Level Employment Employment RSE Employment per 1000 jobs Median hourly wage.

New 2022 Form W-4 - This is the official IRS form - an editable PDF. Switch to Arizona hourly calculator. The above rates apply to Maryland taxable incomeMaryland taxable income is based on your federal adjusted gross income AGI but with some differences.

For example if an employee earns 1500 per week the individuals annual income would be 1500 x 52 78000. To calculate your DTI add all your monthly debt payments such as credit card debt student loans alimony or child support auto loans and projected mortgage payments. Business use percentage if applicable Recovery period of the asset 3 years 5 years 7 years etc.

First use the worksheet found on page 5 of IRS Pub 15-T to calculate the adjusted annual wage amount. Calculate the adjusted wages. Description of the asset.

Calculate your Arizona net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Arizona paycheck calculator. This is the amount you will deduct from your employees paycheck and remit along with your payroll taxes. The tax software will calculate the depreciation on these assets going forward.

Thats why personal finance experts often advise that employees increase the. We assume that the contribution limits for your retirement accounts increase with inflation. Giovanni gets a loan of 1000 on August 4 and receives the proceeds in cash.

The brackets used to calculate your income tax depend on your filing status. To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year. The aggregate method is more complicated and requires you to check out the tax rates listed on IRS.

Account for dependent. The TCJA eliminated the personal. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

California income tax rate. Find the right online calculator to finesse your monthly budget compare borrowing costs and plan for your future. Figure the tentative tax to withhold.

There are two federal income tax withholding methods for use in 2021. Easily calculate your tax rate to make smart. 2023 to 80 2024 to 60 2025 to 40 and.

We stop the analysis there regardless of your spouses age. Know how much to withhold from your paycheck to get a bigger refund Get started. Under this method your employer applies a flat tax rate of 22 to the bonus amount.

Whoathose are a lot of variables. In turn a home with a market value of 500000 and consequently a 350000 assessed value and a mill rate of 50 would pay 17500 in annual property taxes. Next divide by your monthly pre-tax income.

You can calculate the tax for a single person with a taxable income of 41049. California Paycheck Quick Facts. So if your solar installation cost 20000 you would be eligible for an income tax credit of.

This is the simpler method and it tells you the exact amount of money to withhold based on an employees taxable wages number of allowances marital status and payroll period. But the IRS introduced a new Form W-4 beginning with the tax year 2020 that can simplify the process a bit. The second is a volume tax called the spirits liter tax which is equal to 37708 per liter retail or 24408 per liter restaurants and bars.

That 25 limit includes principal interest property taxes home insurance PMI and dont forget to consider HOA fees. That means everyone pays a percentage of their income to the federal government but higher-income filers pay a higher percentage. FAQs on the 2020 Form W-4 - Some guidance for using the new 2020 W-4 Form.

The Withholding Form. The value of the tax credit you earn is based on a percentage of qualifying costs of installing solar panels. Paycheck Calculation References.

Calculating a level of tax withholding thats just right can sometimes take as much time as preparing your tax return. While the number of personal exemptions in Maryland will equal the number of exemptions on your federal tax return the exemption amount is different. Original cost of the asset.

For single filers with an income less than 100000. Subtract the 500 normally withheld from your paycheck from the 2100 total tax due on the 7k.

Hourly Paycheck Calculator Step By Step With Examples

Calculation Of Federal Employment Taxes Payroll Services

How To Calculate Federal Income Tax

How To Calculate Federal Withholding Tax Youtube

Calculation Of Federal Employment Taxes Payroll Services

How Much Does An Employer Pay In Payroll Taxes Payroll Tax Rate

Free Online Paycheck Calculator Calculate Take Home Pay 2022

Federal Income Tax Fit Percent Method How To Calculate Fit Using Percent Method Youtube

Withholding Taxes How To Calculate Payroll Withholding Tax Using The Percentage Method Youtube

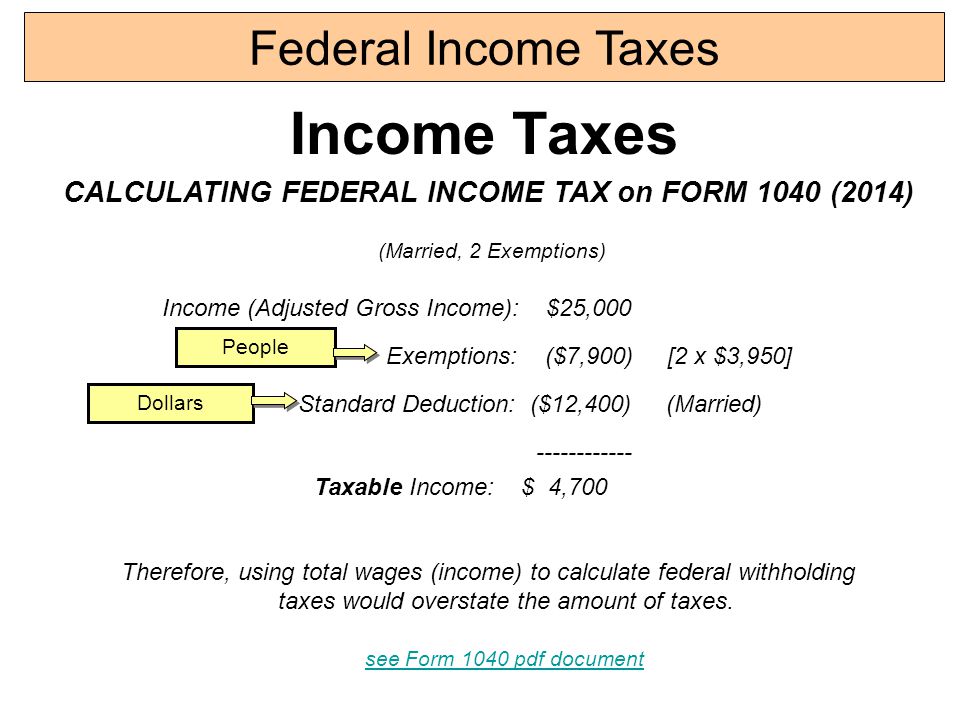

Calculating Federal Income Tax On Form 1040 2014 Ppt Video Online Download

How To Calculate Net Pay Step By Step Example

How To Calculate Federal Income Tax

How Much In Taxes Is Taken Out Of Your Paycheck Morningstar

How To Calculate Federal Income Taxes Social Security Medicare Included Youtube

Paycheck Calculator Online For Per Pay Period Create W 4

How To Calculate 2019 Federal Income Withhold Manually

How To Calculate 2020 Federal Income Withhold Manually With 2019 And Earlier W4 Form